Top Proprietary Trading Firms

Top Proprietary Trading Firms What is a proprietary trading broker? A proprietary trading broker is a financial institution or firm that engages in proprietary trading. Proprietary trading involves trading financial…

Top Proprietary Trading Firms What is a proprietary trading broker? A proprietary trading broker is a financial institution or firm that engages in proprietary trading. Proprietary trading involves trading financial…

The Way to Earn Money from the Stock Exchange! Earn Money When setting a simple take-profit sequence, you limit the prospective yields in your commerce. There’s no way around that,…

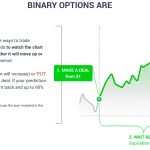

Advantages of Binary Options Trading! The world is filled with a plethora of financial markets, and advances in technology have made each of these markets accessible to the average person…

Who Trades Forex? According to survey results presented in 2025: About 70% male and 30% female. The proportion of women is highest in Europe (41% female). In addition, the median…

What are the best currency pairs for trading binary options? What are the best currency pairs for trading binary options? Binary options trading is a popular form of trading that…

Binary Options USA Brokers! Trading Binary options in the USA has become a popular way to Get and Grow your capital or supplement a current investment portfolio. It’s effortless to…

Candle Graph: How to Use It! Candle graphs have become one of the dealers’ most widely used chart representations. Each candle comprises advice regarding the quotes’ movement throughout a chosen…

Binary Options is the Best Mobile Platform! Dealers interested in exchanging binary options in their Phones or Smart apparatus, particularly those not used to mobile binary options trading systems, may…

Trade with Top Binary Options Brokers! Trading Binary options are a favorite investment option. Instead of purchasing stock and expecting it to rise in value, you only predict that the…

Binary Options Free Demo Account Without Deposit is a virtual money account that lets you practice your trading skills without losing real dollars. There’s a funny story about a man…

Forex No Deposit Bonus! In a vigorous contest for new customers, one of Forex’s agents has made a new fad – No-deposit Forex bonuses, which is unquestionably likely to reap…

Binary Options Low Minimum Deposit Brokers! If you do not want to invest big money in Binary options trading, pick among Those Agents that give you a shallow minimum deposit….

Best Binary Options Brokers and Recommended Trading Bonuses! First, all of the trading platforms presented here guarantee dependable security of private information and reports of its clients against illegal, unauthorized…

Free Trading Signals on Deriv DMT5 Platform! Deriv Group – the owners of the Deriv and Binary com brokers – has a history that dates back to 1999 when the…

Free Entry to Deriv Academy — Build your networks’ trading skills. Free Entry to Deriv Academy – Deriv makes it easy for anyone to start trading, understand risk, and make…

Binary option’s best trading bonuses come in many different sizes and shapes, with agents offering a range of unique rewards; knowing which one you must pick and why may be…

Binary Options trading is the fastest way to make huge profits online. Make Money Online—Binary Options No Deposit Bonuses are the best way to start trading binary options without a…

Binary Options and Forex Free Trading Bots have helped thousands invest more efficiently. With this excellent automated software, you can earn money at home in ways you never thought possible!…

The possibility of trading without depositing real money in your binary options account is a rarity today. Therefore, we prepared for your binary options no deposit bonuses USA Brokers 2025…

Options Trading in the Stock Exchange! Several limitations exist that customers who would like to put money into binary options could outline forex deposits. The sanctions’ orders prohibit bank transfers…

How to Identify Scam Brokers? Some Binary Options websites use the following methods to cheat customers. Change the price of financial markets intends harm to the clients: In this case,…

Most Important Tools for Binary Options Traders! The difference between a binary options trader and a gambler is simple. The educated binary options trader does his analysis before he goes…

Forex Exit Strategy! We take so much time and effort to analyze when it is the most appropriate time to enter a trade; there are lots of charts, indicators, setups,…

BinaryCent Recommended broker for U.S.A. and Canadian customers! Binary options dealers out of the U.S.A. face particular legal difficulties. Legally, agents enrolled with the two government associations that permit and…

Forex Social Party! Being sociable while trading Forex is a little more complicated than when hundreds of people were on the trading floor in the heyday of commodities trading. However,…

What Do Binary Options Mean? “Binary options” means, in short words, a trade where the outcome is a ‘binary’ Yes/No answer. These options pay a fixed amount if they win…

It is not easy for beginners to win when you trade binary options! The easy way to learn how to trade binary options is to Practice with Binary Options and…

IQ Option Binary Options Free Entry Tournament 5000$ Prize Pool! IQ Option Binary is one of the world’s leading online trading platforms. Seize your chance to trade various instruments using…

Best Short-Term Trading Strategy! Recognizing the “right” trade will mean knowing the difference between a good potential situation and one to avoid. Short-term trading can be very profitable but also…

Forex Market Hours and Maximum Profits! In terms of actual Forex market hours, there are three trading sessions in the Forex market: the Tokyo session (7 pm -4 am EST),…